|

THE

FIELDS INSTITUTE FOR RESEARCH IN MATHEMATICAL SCIENCES

20th

ANNIVERSARY

YEAR |

|

November

22, 2012

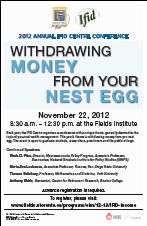

2012

Annual IFID Centre Conference

Theme:

Withdrawing Money from your Nest Egg

8:30 a.m.-12:30 p.m.

Fields

Institute,222

College St., Toronto

|

|

|

|

|

|

|

Confirmed Speakers:

Wade D. Pfau, Ph.D., CFA

Director, Macroeconomic Policy Program, Associate Professor, Economics

National Graduate Institute for Policy Studies (GRIPS)

An efficient frontier for retirement income

This article outlines an approach for building a retirement income

strategy, which moves dramatically away from the financial planner

concepts of safe withdrawal rates and failure rates. The focus

is how to best meet two competing financial objectives for retirement:

satisfying spending goals and preserving financial assets. The

process described here focuses on Moshe Milevsky's production

allocation of assets between a portfolio of stocks and bonds,

inflation-adjusted and fixed single-premium immediate annuities

(SPIAs), and immediate variable annuities with guaranteed living

benefit riders (VA/GLWBs). This process incorporates unique client

circumstances, bases asset return assumptions on current market

conditions, uses a consistent fee structure for a fair comparison

between income tools, operationalizes the concept of diminishing

returns from spending by incorporating a minimum needs threshold

and a lifestyle spending goal, uses survival probabilities to

calculate outcomes, and incorporates retiree preferences to balance

the competing financial objectives for the final choice among

the collection of allocations that define the efficient frontier

for retirement income.

Marie-Eve Lachance, Ph.D.

Associate Professor, Finance, San Diego State University

Roth versus traditional accounts in a life-cycle model with tax

risk

When saving for retirement, individuals can choose between front-loaded

accounts with tax-deductible contributions and back-loaded accounts

without them. Canadian front-loaded RRSPs and back-loaded TFSAs

correspond to U.S. traditional and Roth accounts. This presentation

compares front- and back-loaded retirement accounts by introducing

them in a standard life-cycle model. It discusses how to address

the technical challenges encountered when modeling the realistic

tax treatment associated with these accounts. It highlights that

withdrawals from front-loaded accounts can trigger additional taxes

(repayment of OAS benefits in Canada, taxation of Social Security

benefits in the U.S.), which weakens their relative appeal. Last,

tax risk is added to the model to evaluate the risk reduction benefits

of tax diversification strategies that combine the two types of

accounts.

Thomas Salisbury, Ph.D.

Professor, Mathematics and Statistics, York University

Optimizing variable annuity income

Recently, many variable annuity providers have restricted new sales

of products with guaranteed lifetime withdrawals. Despite this,

a very large pool of existing contract holders face decisions about

how much income to draw from their existing products, and when to

draw it. I will discuss this question from a control theory / American

options point of view. (Joint work with Huaxiong Huang and Moshe

A. Milevsky.)

Anthony Webb, Ph.D.

Economist, Center for Retirement Research, Boston College

Should households base asset decumulation strategies on required

minimum distribution tables?

Households managing wealth decumulation in retirement must trade

off the risk of outliving their wealth against the cost of unnecessarily

restricting their consumption. Devising an optimal decumulation

plan, reflecting uncertain mortality and asset returns, is well

beyond the abilities of most households, who likely rely on rules

of thumb. Using numerical optimization, we compare one such rule

of thumb - consuming the age-related percentage of remaining wealth

specified in the IRS Required Minimum Distribution (RMD) tables

– with alternatives and with the theoretical optimal. We

show that in models that incorporate uncertain investment returns

a decumulation strategy based on the RMD tables performs better

than plausible alternatives, such as spending the interest and

dividends, consuming a fixed 4 percent of initial wealth, or decumulating

over the household’s life expectancy. The RMD tables generally

result in too little wealth being consumed at younger ages, and

are, therefore, relatively attractive to households with low intertemporal

elasticities of consumption. But all the above strategies fall

well short of the theoretical optimum.

Program

8:00 am

Registration, Breakfast/Coffee

8:25 am

Welcome, Edward Bierstone, Director, Fields Institute

8:30- 9:20 am

Wade Pfau

Director, Macroeconomic Policy Program; Associate Professor, Economics,

National Graduate Institute for Policy Studies (GRIPS)

An efficient frontier for retirement income

9:20-10:05 am

Anthony Webb

Economist, Center for Retirement Research, Boston College

Should households base asset decumulation strategies on required

minimum distribution tables?

10:10-10:30 am

break

10:30-11:15 am

Marie-Eve Lachance

Associate Professor, Finance, San Diego State University

Roth versus traditional accounts in a life-cycle model with tax

risk

11:20-12:05 pm

Thomas Salisbury

Professor, Mathematics and Statistics, York University

Optimizing variable annuity income

12:15pm

Networking Lunch

back to top

|

|